Insurtech can be considered the offspring that the Fourth Industrial Revolution has brought to the insurance industry. It is the integration of Big Data, Artificial Intelligence (AI), and the Internet of Things (IoT) – creating a product with a significant role in insurance technology. By analyzing diverse data on demographics, consumer behavior, social ecosystems, as well as health and biometric data, it aims to bring efficiency to modern insurance models.

1. What is Insurtech?

Originating from the term Fintech, InsurTech stands for Insurance + Technology or Digital Insurance Technology. Insurtech refers to the use of newly designed technologies to enhance efficiency and savings in traditional insurance models. Activities in the insurance process are conducted online through the Internet, from initial stages such as customer research, product design, marketing, to later stages like sales, contract negotiation, and post-sales operations such as customer care, assessment, and claims processing.

Subsequent technology applications are also utilized in online sales, insurance operations such as risk assessment, and even appraisal, pricing, or reinsurance. Notable InsurTech companies may include original insurance companies, intermediary roles, or technology solution providers supporting traditional large-scale insurance companies. In Vietnam, InsurTech has emerged in recent years and gained a certain position. Most large insurance companies have developed applications or online platforms to serve business operations more efficiently. Alongside the strong entry of foreign InsurTech companies, there are also emerging startups in Vietnam, such as INSO, SaveMoney, MIIN, or Papaya. These companies often have smaller scales and mainly act as intermediaries, providing technology services to large-scale original insurance companies.

2. Characteristics of Insurtech

As the offspring of the global Fourth Industrial Revolution, Insurtech embodies the characteristics and advantages of this revolution. By collecting, analyzing, and processing a large volume of data on interests, behaviors, consumer habits, insurance companies can approach customers with diverse tools, from product design, risk assessment, insurance pricing to quick, convenient, and suitable claims processing.

The combination of modern technology factors in the insurance business is highly potential, not only for insurance companies but also for other startup opportunities, financial institutions, and high-tech corporations. This breakthrough creates a difference in the current captivating insurance technology race. According to a research collaboration between the Institute of Insurance Economics IVW-HSG University of St. Gallen and the Swiss Re Institute, Insurtech is recognized through several categories:

- Comparison Portals

- Digital Brokers

- Insurance Cross Sellers

- Peer-to-Peer

- On-Demand Insurance

- Digital Insurers

- Big Data Analytics and Insurance Software

- Internet of Things (IoT)

- Blockchain and Smart Contracts

3. Opportunities for Insurtech Development in Vietnam

Leveraging the advantages of modern technology, Insurtech explores diverse business areas that large insurance companies may find challenging or resource-intensive to exploit. This includes providing more flexible policies, social insurance coupled with the use of new data streams from Internet-connected devices to flexible insurance cost calculations.

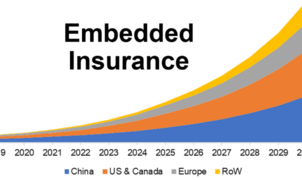

With the influence of the COVID-19 pandemic, the current digital transformation trend is accelerating due to unprecedented challenges. In this context, insurance products are also heavily invested in technology to enhance customer access and optimize user experiences, affirming the attractive potential in financial companies today. In 2020, global investment in Insurtech reached $7.5 billion.

The insurance industry has positively transformed, offering customers faster and more diverse access to insurance, enriched with advanced and professional technologies. Moreover, it is predicted that in the coming year, with around 50 million people joining the middle-income class, the Southeast Asia region will have more than 350 million people with an income of up to $300 billion. With 70% of the Southeast Asian population using the Internet, this is a highly promising landscape for insurance technology development.

Interest in the Insurtech market in Vietnam is not only coming from domestic investment funds, but also from many international investment funds. Insurtech companies in Vietnam are emerging rapidly to meet market demands.

4. Challenges Presented for Insurtech

Despite the numerous advantages and potential opportunities, InsurTech faces several challenges:

Firstly, the legal framework in Vietnam has not specifically addressed insurance activities with new business models. Technological innovation in the insurance sector can disrupt market stability, making it difficult to manage and control distribution channels as traditional methods. This challenge poses specific difficulties for the State management agency in regulating the insurance industry and controlling the operations of insurance companies.

Secondly, the current high-quality workforce, with rigid specialized skills, is insufficient to meet the development needs of Insurtech. To adapt to the rapid application of technology in modern Insurtech, companies need to seek high-quality labor, understanding new technologies.

The current workforce is not adequately prepared for the rapid changes brought about by digital technology, especially in new fields such as Data Science, UX Design, or Digital Marketing…

Thirdly, the ongoing fluctuations in the global economy will also significantly affect the financial situation of insurance companies in the future. For example, the current low-interest rates worldwide are putting pressure on the financial efficiency of insurance companies. Customers tend to avoid purchasing insurance if the interest rates are lower than those of bank deposits, leading to a decrease in both revenue and profit for insurance companies.

For the Insurtech market in Vietnam to develop further in the future, Vietnam needs to improve the legal framework for Fintech, specifically for Insurtech, and create favorable conditions for companies to operate. Furthermore, Insurtech companies need to continue enhancing the training of highly specialized personnel and collaborating with traditional insurance companies to take advantage of capital, diverse products, and a better market share.

Thus, with the ongoing trend and continuous development of technology 4.0 globally, the Insurtech market is assessed to have explosive potential. Especially with the growth of young generations who have been exposed to modern technology from a young age through digital devices, it is hoped that the information provided by the Admin will be useful to you. Wishing you success!

Cre: vegafintec